Tech Sector Surges 8% While These 6 Stocks Tell Different Stories

The Nasdaq has reached a record high with a nearly 8% increase this year, while several companies present mixed investment opportunities. Gartner's services are in high demand as businesses navigate AI complexities, and AMETEK thrives in the industrial automation sector. While gold and defense firms like L3Harris see gains amid uncertainty, Tapestry struggles with declining consumer spending on luxury goods.

Trump's 40% tariff bombshell just flipped Singapore's 1.85% T-Bills - here's what traders missed

Vietnam secures a zero-tariff deal with the U.S. while China faces a heavy 40% tariff, reshaping the Asian trade landscape. As Vietnam's stocks soar, Singapore's financial allure wavers with declining Treasury yields prompting investor concerns. Smart investors are pivoting to Southeast Asian tech and infrastructure as companies rethink supply chains amidst ongoing trade tensions.

Bolivia's bonds surge 20% as traders bet on political change

Bolivia's bonds surged 20% due to political speculation ahead of the August 2025 elections, not just economic factors. Investors are betting on potential regime change, while locals are fleeing to cryptocurrencies amid inflation. The bond rally reflects hope instead of hard economics, raising questions about the sustainability of returns amid structural challenges.

Vietnam's 7.96% GDP surge caught traders off guard - here's why

Vietnam's Q2 2023 GDP surged by 7.96%, fueled by an 18% boost in exports, creating a surprising trade surplus. The reduction of a proposed 46% tariff to 20% on Vietnamese imports has been a game changer for local businesses, enhancing export opportunities. While the stock market rallies, currency depreciation is raising import costs, forcing companies to navigate complex trade dynamics carefully.

EU's $50B Critical Minerals Strategy: Why Smart Investors Are Ditching China Dependencies

The EU is stockpiling critical minerals like lithium and cobalt to reduce dependency on China's 70% market control, spurred by rising supply chain risks. Investment opportunities in mining and processing companies are expected to grow as the EU shifts focus to securing essential resources. Investors should monitor companies innovating in sustainable extraction, as demand for critical minerals is set to rise amid geopolitical tensions.

Google's AI Overviews just triggered Europe's biggest antitrust complaint - here's what it means for your tech stocks

European publishers are suing Google over its AI Overviews feature, claiming it undermines their ad revenue by summarizing their content without consent. The complaint raises serious concerns about the relationship between AI companies and content creators, potentially redefining content usage and compensation. Investors should watch this case closely, as the outcomes could significantly impact the regulatory landscape for AI and tech companies.

Wall Street analysts just upgraded CME Group to $300 - here's why traders are paying attention

Wall Street Zen upgraded CME Group from 'sell' to 'hold,' indicating newfound confidence in the derivatives exchange giant. CME Group reported earnings per share of $2.80, beating expectations, with analysts predicting continued strong performance. While market volatility can hinder others, it actually benefits CME Group by driving increased trading activity and revenue.

Crypto bills targeting $4 trillion market could transform your portfolio by 2035

Congress is set to vote on three transformative cryptocurrency bills that could unlock a $4 trillion stablecoin market by 2035. The GENIUS Act aims to ensure stablecoins are fully backed by liquid assets, while the CLARITY Act intends to clarify regulatory authority between the SEC and CFTC. With Bitcoin testing a crucial resistance level, the outcome of these bills could significantly impact market momentum and institutional investment in digital assets.

Trump's $3.4 Trillion Tax Cut: Why Goldman Sachs Is Sounding the Alarm

Trump signed a $3.4 trillion tax cut on July 4th, significantly increasing the national debt, while benefiting the wealthy. Goldman Sachs warns the U.S. debt trajectory resembles WWII levels, with interest payments expected to exceed $1 trillion by 2026. Higher government borrowing could lead to increased mortgage rates and complicate the Fed's inflation efforts, creating challenges for future lawmakers.

IndusInd Bank just posted a 3.1% drop - here's what the derivatives scandal means for your money

IndusInd Bank's Q1 2025 results reveal a 3.1% drop in net advances and a significant 14.4% decline in corporate banking, resulting in the bank's first quarterly loss in two decades at ₹2,328 crore due to a derivatives scandal. Despite the troubles, the consumer segment grew by 4.8% year-on-year, and Nomura has upgraded the bank's target price by 50%, indicating some analysts see potential for recovery. Investors should approach with caution as the bank focuses on rebuilding trust amid a challenging environment, while public sector banks show healthier growth.

These 2 new crypto listings could transform your portfolio - here's what traders need to know

RESOLV and HOME are debuting on Bitkub's trading roster on July 8, 2025, amidst a volatile crypto market. RESOLV targets institutional investors while HOME aims for retail appeal through community engagement. Investors should stay informed and approach these listings with caution, balancing the potential for quick profits against market risks.

Chinese Chip CEO Drops $50M on Binance Coin - Plans $1B Shopping Spree

Nano Labs plans to invest $1 billion in Binance Coin, aiming to acquire 10% of the circulating supply, despite concerns about the practicality of their strategy. The initial excitement from Nano Labs' stock surge of 106% is fading as investors question the value of buying crypto through a company rather than directly. Binance is countering skepticism by offering zero-interest loans with leverage for institutional clients, raising questions about the viability of crypto treasuries like Nano Labs' model.

Bitcoin whale moves $5.4 billion after 14 years - here's what it means for your portfolio

A Bitcoin whale moved $5.4 billion worth of BTC after 14 years, shaking up the market as Bitcoin struggles to stay above key support levels. Despite a massive withdrawal, some indicators show continued interest in Bitcoin, with futures open interest rising 10%. The upcoming week could determine Bitcoin's direction, as traders watch for whale patterns amidst mixed market signals and macroeconomic factors.

AI trader reveals why 77% of devices use AI but can't predict Bitcoin crashes

Despite 77% of devices using AI, predicting crypto prices like Bitcoin remains a challenge. Apple's AI strategy focuses on seamless integration while competitors engage in an arms race. Effective trading combines AI analysis with human intuition to navigate the unpredictable crypto market.

Trump Family Slashes WLFI Stake by 20% While Proposing $620M Token Trading Revolution

The Trump family is making their World Liberty Financial governance tokens tradable while reducing their ownership from 75% to 60%, in a strategic move amid political scrutiny. As institutional investors pour in funds and the USD1 stablecoin gains traction, WLFI's shift towards decentralized governance poses a test for the future of crypto regulation. This initiative could redefine how crypto projects balance decentralization and regulation, attracting attention from smart money and potentially shaping the landscape of digital finance governance.

Tech CEOs just revealed why these AI chip restrictions could make you rich

The U.S. is tightening AI chip export rules for Malaysia and Thailand while easing restrictions for China, reflecting a confusing shift in trade policy. China is responding to U.S. restrictions by building its own semiconductor ecosystem, potentially changing the balance of power in future trade negotiations. Investors should focus on companies capable of navigating this tech cold war and maintaining flexible, resilient supply chains.

RITFIT CEO reveals how home fitness pivot could reshape your portfolio

RITFIT is shifting from budget-friendly fitness to premium customization at HomeGymCon 2025, catering to modern consumer desires for high-end home gym solutions. Their new M2 training machine highlights a trend in the fitness industry towards personalization and offering experiences rather than just products. As RITFIT pivots to premium offerings, investors watch closely, betting on consumers' willingness to pay more for customized home fitness solutions in a post-pandemic market.

Scottish traders watch GBP/JPY plunge 2% as Trump's July 9 tariff deadline looms

Scotland's economy is growing at a sluggish 0.8% this year, impacted by Trump's tariff policies and rising costs. Prime Minister Starmer's diplomatic ties with Trump are stirring internal tensions within the Labour Party amidst stagnant GDP growth. With GBP/JPY facing downward pressure due to trade uncertainties, traders are advised to remain cautious as the July 9 deadline approaches.

Oil explorer hits 52-week high of $0.80 - but insider just sold 50,000 shares

Rockhopper Exploration's stock hit a 52-week high but saw an insider sell 50,000 shares at a lower price, raising questions about timing. Analysts have upgraded the price target significantly, but with a staggering PE ratio of 26,925.42 and negative earnings expected, investing is highly speculative. While the company's financials show strength, insider selling amidst rising stock prices suggests caution for potential new investors.

UBS Analyst Sets $130 Target on Exxon - Here's Why Oil Beats Growth Stocks

UBS is betting on Exxon Mobil with a $130 price target, emphasizing the continued relevance of traditional oil investments over volatile growth stocks. While energy prices fluctuate, Exxon's strong market cap and consistent dividends offer a safe haven compared to the drama surrounding EV stocks like Rivian. Investing in Exxon's steady returns might provide a strategic hedge against the uncertain future of newer energy ventures, balancing current energy needs with eventual growth risks.

Finance Minister reveals £75 billion pension shake-up - what it means for your retirement

Rachel Reeves is set to unveil important pension reforms on July 15, addressing the dire state of the UK's retirement savings system. Key focuses include improving contributions for self-employed workers and potential changes to workplace auto-enrolment schemes. Employers should brace for regulatory shifts impacting benefits, while employees need to stay alert for updates that could affect their financial futures.

Singapore's $4.2B retail sales jump 1.4% - but only cars are selling

Singapore's retail sales rose 1.4% in May, but without motor vehicles, growth was nearly flat, highlighting dependency on car sales. Apparel, petrol stations, and department stores saw declines, indicating consumers are tightening their spending amidst a cooling job market. Investors should diversify away from sectors reliant on discretionary spending as economic uncertainties loom ahead.

Singapore Banks Just Got Hit with $21.54 Million in Fines - What It Means for Your Portfolio

Nine banks, including Citibank and UBS, were fined $21.54 million by Singapore's MAS for failing anti-money laundering regulations amid a $2.3 billion scandal. The incident underscores the necessity of compliance in banking, with affected institutions vowing to improve their oversight and monitoring systems. Investors should watch for banks that strengthen their compliance frameworks, as these may become safer long-term investments amidst increased regulatory scrutiny.

CEO drops $50M on BNB tokens - here's why the market isn't impressed

Nano Labs is on a $1 billion crypto shopping spree, purchasing $50 million in BNB tokens while aiming for 5% to 10% ownership of all BNB in circulation. Despite the large investment, Nano Labs' stock plummeted post-announcement, raising questions about the strategy behind buying crypto through a company. The firm's ambitious move to acquire BNB could face challenges due to the token's connection to Binance's legal issues, leaving investors skeptical about potential gains.

EV Stocks: Rivian's $4.7B Cash vs Lucid's Bleeding - Why One CEO Sleeps Better

Trump's tax reforms create challenges for the EV industry, particularly for smaller players like Rivian and Lucid Group. Rivian boasts strong cash reserves and a competitive vehicle strategy, while Lucid struggles with high operational costs and needs to improve efficiency. The evolving market landscape highlights the importance of cash flow and consumer-friendly products for success in the competitive EV sector.

This $40 Trillion Debt Surge Could Send Bitcoin to $150,000 - Expert Explains

Trump's latest spending bill could push Bitcoin to $150,000 as national debt rises, making Bitcoin appealing amidst currency dilution. While expansive fiscal policies may favor Bitcoin as a hedge against inflation, they also increase market volatility. With July declared 'Crypto Week', regulatory clarity might boost Bitcoin's appeal, but navigating government changes remains crucial for investors.

Bezos sells $736.7M Amazon stock days after wedding - what this means for your portfolio

Jeff Bezos sold $736.7 million in Amazon shares shortly after his wedding, but it was part of a planned trading strategy and not a sign of trouble for the company. Amazon's cloud division, AWS, continues to thrive with over 30% of the market and significant investments in AI, setting the stage for long-term growth. Investors should focus on Amazon's strong fundamentals rather than billionaire stock sales, as the company is poised for transformation and profitability.

Thai Finance Minister races against 36% tariff deadline - $55B export market at stake

Thailand and the US are in high-stakes trade negotiations with a July 9 deadline, where a potential 36% tariff could threaten Thailand's $55 billion export relationship. America accounts for 18.3% of Thailand's exports, making the outcome crucial as a failure could lead to job losses and a significant economic downturn. The resolution of this trade drama will impact Southeast Asian markets and global supply chains, emphasizing the importance of diplomatic negotiations in preventing economic crises.

Indian Banks Hit 13.7% Growth - Traders Discover Hidden Profit Secret

UCO Bank reports a 13.7% business growth while public sector banks show surprising strength with solid advances. Morgan Stanley predicts Indian market momentum in Q3 FY26, supported by government stimulus and improving growth data. Investors should focus on fundamentally strong public sector banks amidst market volatility and global risks for better opportunities.

Two Major Banks Just Rejected $30 Million Aid Foundation - Here's Why

The Gaza Humanitarian Foundation faced banking rejections from UBS and Goldman Sachs due to inadequate transparency in funding sources during compliance season. Despite having $30 million in government pledges, the foundation's operational model and lack of clear documentation highlighted the risks financial institutions perceive in humanitarian financing. GHF's pivot to focus on U.S. operations underscores the necessity for humanitarian organizations to maintain strict compliance and transparency to secure banking relationships.

Tata Group's Air India gamble crashes harder than their stock price

Air India Express is facing significant safety violations, including failing to replace critical engine components and allegedly forging maintenance records. These issues come after a tragic crash, jeopardizing Tata Group's plans to transform Air India into a world-class carrier. The company must implement comprehensive safety measures and operational discipline to avoid turning their investment into a cautionary tale.

Nike CFO reveals $1 billion tariff hit - what this means for sneaker prices

Nike faces a $1 billion cost increase due to new 20% tariffs on Vietnamese imports, affecting half of its shoe production. The tariffs may force companies to reconsider their supply chains, potentially shifting back to China despite its risks. Expect 'surgical price increases' from brands like Nike and Adidas, impacting consumer wallets as costs rise.

Barclays Just Hiked Oil Forecasts to $72 - Here's What It Means for You

Barclays raises its Brent oil price forecast to $72 per barrel for 2025, acknowledging a resurgence in demand driven by OECD countries. The U.S. oil demand surge points to a recovering economy, as global crude inventories shrink and OPEC+ output struggles to meet targets. Traders should consider positioning in oil futures or ETFs as stronger demand and managed supply suggest potential healthy returns in the coming years.

Cascadia CEO just raised $2.3M while copper prices stumble - here's their bold plan

Cascadia Minerals Ltd. raised over C$2.27 million in a successful financing round, oversubscribing by a significant margin, indicating high investor demand. The funds will be used to acquire Granite Creek Copper Ltd. and the promising Carmacks Project in Yukon, which has substantial copper and gold reserves. Cascadia's strategic positioning in the growing copper market aligns with the green energy transition, making it a potential long-term investment opportunity.

This crypto just surged 108% while Bitcoin crawled - traders eyeing $100

Hyperliquid (HYPE) has skyrocketed with a 108% increase in Total Value Locked, hitting $1.46 billion and eyeing a $100 price target as it outperforms Bitcoin by 40%. Hedera (HBAR) has broken free from its previous patterns, trading at $0.16 with potential to reach $0.20 if it maintains momentum above the resistance level of $0.155. Traders should consider accumulating HYPE in the $39 to $38 range and keep a watchful eye on HBAR's performance to capitalize on these breakout opportunities.

JD.com CEO fights fake stablecoin scams while hunting real license in Hong Kong

JD.com is denying association with fraudulent stablecoin scams while applying for a legitimate stablecoin license in Hong Kong. CoinDCX faces backlash after unexpectedly delisting trading pairs due to regulatory pressures in India. The contrasting approaches of JD.com and CoinDCX highlight the importance of navigating regulatory challenges in the evolving Asian crypto landscape.

Santos CEO lands $18.7B takeover bid while signing Qatar deal - here's what it means

Santos secures a mid-term LNG supply deal with QatarEnergy while facing an $18.7 billion takeover bid from ADNOC, keeping options flexible in a volatile market. The Barossa project is set to boost production by 30% by 2026, crucial for maintaining output as older fields decline. Investors should focus on Barossa's progress, the new LNG deal's effectiveness, and regulatory responses to ADNOC's bid for informed trading strategies.

UBS and Goldman Sachs CEOs reveal why 2025's biggest winners avoid this portfolio mistake

Investors are shifting from traditional 'buy and hold' strategies to more dynamic, active portfolio management amid economic stabilization. UBS promotes investment in artificial intelligence, renewable energy, and longevity sectors, marking a shift towards sustainability-driven growth. Building a diversified portfolio with resilient, sustainable assets is now essential in navigating current global uncertainty and risks.

ComfortDelGro CEO just revealed their $4.5B strategy - here's what it means for your portfolio

ComfortDelGro's stock has steadily climbed to $1.43 since its IPO, yielding a 6.4% total return when including dividends. The company is aggressively expanding globally, with over 52% of its revenue now coming from international ventures and a new robotaxi service in China. Investors should monitor ComfortDelGro's ability to successfully integrate its recent acquisitions to ensure continued growth amid rising competition.

Japanese Households Just Spent 4.7% More - Here's Why Your Portfolio Should Care

Japanese households boosted spending by 4.7% year-over-year in May 2025, significantly outperforming expectations, thanks to a 5.25% wage increase from companies. The Bank of Japan is caught between celebrating consumer confidence and worrying about global trade tensions that could derail the recovery. Investors should monitor Japanese consumer behavior and global trade developments, as both factors can impact portfolio strategies amidst this cautious optimism.

Microsoft CEO cuts 9,000 jobs while spending $80B on AI - here's the math

Microsoft is laying off 9,000 workers to fund an $80 billion investment in AI, challenging traditional corporate cost-cutting logic. This strategy targets revenue-generating teams, signaling a shift in how companies prioritize workforce and technology amidst an AI gold rush. Investors should monitor cloud adoption rates and product innovations to gauge the success of Microsoft's bold restructuring.

TMDX jumps 48% on $143M revenue beat - but short sellers are circling

Short sellers are targeting TransMedics Group (TMDX) despite its strong revenue growth, anticipating another earnings miss, while retail investors are fleeing Nykaa despite its rising customer base. Nykaa's stock is seeing increased institutional investment, signaling confidence amidst a retail exodus driven by past performance concerns. TMDX offers a growth story with volatility as short interest rises, while Nykaa presents operational potential overshadowed by shifting shareholder dynamics.

Trader reveals why 25% international stocks beats your S&P 500 obsession

The dollar is falling, making international stocks appealing as they offer better value and diversification opportunities. Despite US and international stocks still showing correlation, diversifying your portfolio can protect against local market downturns. Wealthy investors are shifting focus from traditional bonds to equities and alternative investments, emphasizing the importance of liquidity and smart risk management.

Nykaa founders just sold $140M worth of shares - here's why smart investors aren't panicking

The Banga family sold $140.3 million in Nykaa shares as stock prices fell, illustrating the importance of timing in the beauty industry. Despite a dip in share value, Nykaa's business shows strong growth, particularly in its House of Brands segment with significant revenue increases. Investors might find opportunity in the recent stock drop, as historical patterns suggest recoveries often follow early investor exits.

Singapore's GDP forecast drops to 1.7% but this economic zone could change everything

Singapore expands the Johor-Singapore Special Economic Zone to include Indonesia's Riau Islands, creating a powerful regional investment hub. This collaboration offers reduced regulatory headaches for businesses and could help retain talent across the three territories. Investors should watch for growth in manufacturing, technology, and sustainable development as regional cooperation shapes Southeast Asia's economy.

Trader who called March 2023 crash reveals why today's 111,000 jobs report could trigger Fed rate cuts

The job market just lost 33,000 jobs in May, raising concerns ahead of today's Non-Farm Payroll report that forecasts modest growth and higher unemployment rates. A weak NFP report could lead to a drop in the dollar as rate cut expectations increase, while GBP/USD faces crucial support levels amidst ongoing UK economic struggles. Trade tensions with Vietnam also add complexity to inflation concerns, making the Fed's decisions more nuanced as they navigate these economic challenges.

German utility cuts 400 jobs while oil giant builds ships - here's why

Uniper cuts 400 jobs due to falling power prices and regulatory challenges, signaling turbulence in Europe's energy sector. As larger companies consolidate, smaller players face market pressure, potentially leading to higher consumer prices. ONGC’s investment in ethane carriers amidst profit drops exemplifies risky long-term strategy in a volatile market influenced by geopolitical factors.

Chinese CEO bets $1.3 billion on Bitcoin with $6.83 million company

Addentax Group Corp. plans to buy $1.3 billion worth of Bitcoin despite its market cap being only $6.83 million, raising concerns about financial viability. Over 250 companies are entering the Bitcoin market, but skeptics, including Senator Elizabeth Warren, warn of potential economic risks and a lack of substantial value creation. The outcome of these ambitious corporate Bitcoin strategies will reveal whether they lead to success or serve as cautionary tales in the face of market volatility.

Bitcoin Suisse's General Counsel reveals why $3 trillion stablecoin market faces regulatory chaos

Europe's stablecoin regulations are in disarray, creating operational headaches for companies trying to navigate ever-changing rules. Switzerland's impractical KYC requirements for stablecoin issuers may force companies to choose between compliance and sanity. While Europe debates regulations, the U.S. is advancing with the GENIUS Act, risking a lost opportunity for the stablecoin market in Europe.

Shein just got hit with a $47 million fine - here's why your portfolio should care

Shein was fined €40 million for misleading pricing tactics, with 57% of their advertised discounts deemed deceptive. The regulatory scrutiny reflects a global trend in e-commerce, pushing companies towards transparency and ethical practices. As Shein prepares for an IPO, this hefty fine signals potential investor caution and highlights the importance of compliance in retail.

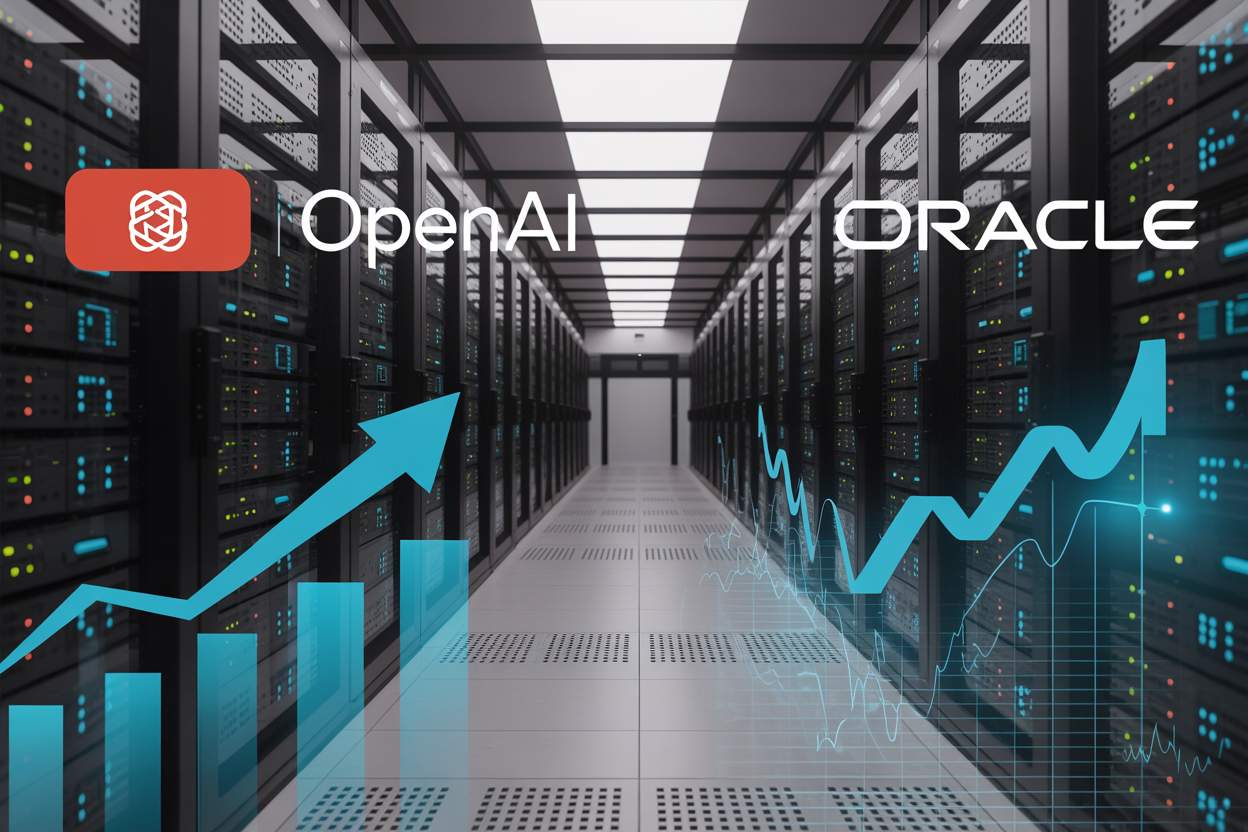

OpenAI's $30 Billion Oracle Deal Just Changed Everything - Here's What Your Portfolio Needs Now

OpenAI's $30 billion partnership with Oracle marks a significant shift in AI infrastructure, enabling Oracle to triple its projected cloud revenue by 2025. This deal highlights a diversification away from Microsoft as OpenAI seeks more computing power from multiple providers, intensifying competition among tech giants. Investors should note that while Oracle's revenue is boosted, the need for heavy investments in data centers poses execution risks and the potential for increased competition in the AI market.

Trump's Vietnam Deal: 20% Tariff Beats 46% Threat - What This Means for Your Portfolio

Trump's reduced tariff on Vietnam highlights the pressure countries face when reliant on a dominant trading partner. This deal serves as a warning for other nations, as they reconsider their trade strategies under U.S. pressure. Investors should brace for volatility in emerging markets as geopolitical tensions dictate economic outcomes.

Raymond Ltd drops 4.43% to ₹724 - but CEO Singhania's textile empire shows surprising resilience

Raymond Ltd dropped 4.43% to ₹724.45 after a strong 20.65% surge, highlighting market volatility. Despite recent challenges, Raymond's fundamentals suggest potential long-term benefits for investors who spot opportunities in setbacks. The company's focus on sustainability and product diversification may aid in navigating economic uncertainties.

Fed Chair who rejected Trump's rate cut demands faces firing threat

Trump's demand for Powell's resignation due to his reluctance to cut interest rates is causing market jitters. Powell's cautious approach is at odds with Trump's push for aggressive stimulus, leading to heightened uncertainty in the markets. With Powell's term lasting until 2026, the Fed's independence is being tested amidst political pressure, foreshadowing continued market volatility.

Bitcoin hits $109,000 as $55 trillion money supply creates perfect storm

Bitcoin just hit $109,000 as global money supply reaches $55 trillion, driving interest in the cryptocurrency amidst excessive fiat liquidity. Institutional cash is pouring in with Bitcoin's open interest up over 10%, indicating serious demand rather than mere speculation. Technical analysis suggests a bullish rally could continue, with analysts eyeing $137,000 as the next target while volatility remains low.

CTP CEO reveals how 13.4 million sqm empire survived brutal 2025 market crash

CTP N.V. is Europe's largest listed logistics real estate operator with 13.4 million square meters of warehouse space, set to release its H1-2025 results on August 7 amid rising interest rates and inflation. The company is heavily investing in sustainability, earning a 'negligible-risk' ESG rating, which could attract eco-conscious investors looking for profitable opportunities. Investors should monitor CTP's occupancy rates, rental growth, and the impact of sustainability initiatives on profits to determine if they can successfully merge environmental responsibility with financial performance.

OpenAI's $30 billion Oracle deal reveals why AI infrastructure will make (or break) your portfolio

OpenAI's $30 billion investment in Oracle surpasses Oracle's entire cloud revenue and highlights the growing need for robust AI infrastructure. As tech giants like Meta and Oracle ramp up spending on AI data centers, the race for AI dominance intensifies amid a backdrop of high-risk, high-reward investment opportunities. The OpenAI-Oracle deal signifies the critical role of advanced computing power in AI's evolution, akin to the importance of electricity in the industrial revolution.

FPT CEO reveals how $100M digital banking partnership transforms Asia Pacific finance

FPT Corporation and audax Financial Technology partnered for $100 million to transform Asia Pacific's digital banking landscape, aiming for a rapid growth in a traditionally strong sector. With 3,000 engineers and a user-friendly digital platform, they target financial inclusion in underbanked areas as the market is projected to grow by 110% by 2030. Investors should consider backing companies that leverage partnerships and technology to adapt, as those resisting change risk becoming obsolete.

Trump's $3.4 Trillion Bill Could Cost 17 Million Americans Their Healthcare

July 4th marks a critical deadline for a $3.4 trillion healthcare bill that could dramatically impact the U.S. economy and healthcare access. Up to 17 million Americans may lose health insurance due to Medicaid cuts, while investors should watch for shifts in healthcare stock valuations. Crisis often creates opportunity; telehealth and alternative care providers could thrive amidst traditional healthcare challenges.

Datadog's 11% surge reveals why S&P 500 inclusion makes millionaire investors rich

Datadog is set to join the S&P 500 on July 9, 2025, a move that will force index funds to buy its stock, boosting its investment profile immensely. Tesla reported strong Q2 delivery numbers, which may lead to upgraded sales forecasts and increased investor confidence despite market volatility. Investors can expect steady growth from Datadog through its S&P 500 inclusion, while Tesla presents a riskier but potentially more rewarding opportunity based on delivery performance.