Microsoft CEO just dropped $30B on UK tech - here's what it means for your portfolio

Microsoft and Alphabet are investing a combined $42 billion in UK tech, focusing on AI and quantum computing, amid rising competition from China. UK Tech Secretary promises advancements will enhance daily life, while investors should prepare for volatility but potential growth in the sector. The investment signals a strategic shift in US-UK tech relations, presenting opportunities but also regulatory challenges for traders.

Fed traders betting 96% on rate cuts - here's why USD/JPY just hit 146.20

The dollar is struggling due to high expectations of a 25 basis point rate cut, alongside disappointing labor market data revealing 919,000 fewer jobs than reported. USD/JPY has dropped significantly, with technical indicators favoring a bearish outlook, especially if it breaks below the 146.50 support level. Traders should be cautious with long USD/JPY positions as a dovish Fed and potential hawkish signals from the Bank of Japan could drive the yen higher.

CZ drops 'ex-Binance' from bio as BNB eyes $920 - what this means

CZ's bio change hints at a potential return to Binance, impacting crypto market sentiment. Binance is negotiating to ease DOJ compliance restrictions post $4.3 billion settlement, signaling a shift towards regulatory compliance. BNB shows bullish momentum amid changing fee structures and increasing institutional interest, creating trading opportunities amidst uncertainty.

Xiaomi CEO just skipped phone model 16 - here's his $14B bet against Apple

Xiaomi is skipping the 16 and launching the Xiaomi 17 series with a bold marketing strategy, backed by a $14 billion R&D investment. This shift from budget-friendly to premium smartphone competitor aims to position Xiaomi alongside Apple in the premium market. The success of the Xiaomi 17 will hinge on effective pricing, innovative features, and whether consumers are ready to see Xiaomi as a flagship brand.

Mastercard CEO just revealed AI agents will handle your holiday shopping - here's why

Mastercard's new Agent Pay program allows AI to shop on your behalf, launching this holiday season for U.S. cardholders. The system prioritizes security, requiring permission for transactions and using verifiable credentials for safety. Early adopters like Citi and U.S. Bank will shape the future of agentic commerce, potentially transforming the payments landscape.

DeFi Development Corp drops $77 million on Solana - here's why this changes everything

Ethereum is the trusted luxury option in DeFi while Solana's rapid growth appeals to speed-focused investors. A recent $77 million investment in Solana signals institutional confidence, positioning it as a serious competitor to Ethereum. Both Ethereum and Solana cater to different market needs, creating opportunities for investors in a maturing crypto ecosystem.

ADNOC's $18.7 Billion Santos Bid Flops - Why Foreign Buyers Keep Striking Out

ADNOC's $18.7 billion bid for Santos collapsed due to Australia's tough regulatory environment and an unenthused market response. In contrast, Singapore's co-living sector is booming, attracting investments and showing steady demand from international students. Investors are learning that successful international expansion requires understanding local dynamics and recognizing when to walk away.

Manchester United's £175 Million Loss Streak Reveals Why Even Billionaire Owners Struggle

Manchester United faces its sixth consecutive year of losses with a £33 million net loss, despite £666.5 million in revenue, raising concerns about profitability under financial regulations. Unilever is set to spin off its ice cream business after co-founder Jerry Greenfield's resignation, which highlights the challenges of maintaining brand identity amidst corporate culture clashes. Investors should be wary of companies struggling to turn revenue into profits and managing subsidiary relationships, as these issues could signal deeper risks to returns.

Economic expert reveals why India's September reforms could mint millionaire traders

India is reforming its commodity markets while still facing challenges in labor and land issues, drawing comparisons to early 2000s China. SEBI's new rules allow banks and foreign investors to participate in commodities, potentially boosting liquidity and price discovery. Despite optimism for growth with upcoming trade agreements, India needs to address regulatory hurdles to attract investment effectively.

Baidu surged 12% while NVIDIA faces China's breakup letter - here's what it means

Baidu's stock surged 12% as it strengthens its AI market position amid tightening U.S. export restrictions, signaling a shift towards Chinese tech independence. NVIDIA faces potential market share decline from 66% to 55% as local competitors rise, despite launching a new B30A chip tailored for the Chinese market. Investors should consider diversifying between Baidu for exposure to China's AI growth and NVIDIA for its established global presence as geopolitical factors reshape the landscape.

MoonPay CEO reveals why this $X acquisition could transform your crypto payments

MoonPay's acquisition of Meso strengthens its position in connecting U.S. banking with crypto, creating a unified payment system for multiple currencies. Alipay+ is launching cross-border QR payments in Saudi Arabia, supporting local businesses and aligning with the country's Vision 2030 for economic diversification. These developments highlight a shift towards a seamless financial ecosystem, where traditional banking and fintech operations integrate for better consumer experiences.

Fed cuts could push NZD past 60 cents - trader reveals why this matters

The US Dollar is struggling due to anticipated Fed rate cuts, with the New Zealand Dollar and Euro emerging as unlikely beneficiaries. NZD/USD has surged past 0.6000, but upcoming New Zealand GDP data could pose risks for further gains. The Euro is gaining ground as the ECB maintains a hawkish stance while the Fed leans dovish, creating a divergence that favors the Euro.

Snap investors who lost money in fraud lawsuit have until October 20 to fight back

Snap Inc. is facing a class action lawsuit for allegedly misleading investors about its advertising growth and revenue issues between April and August 2025. Affected investors have until October 20, 2025, to join as lead plaintiffs without upfront legal costs due to contingency fee arrangements. This case highlights a growing demand for corporate accountability and encourages investors to scrutinize optimistic claims from CEOs.

Trump's $15 Billion Lawsuit Targets NYT as His Memecoin Crashes 88%

Donald Trump is suing The New York Times for $15 billion, claiming negative coverage harmed his TRUMP memecoin, which has plummeted 88%. The lawsuit raises questions about the risk of investing in memecoins, which are driven by public sentiment rather than intrinsic value. Trump's legal strategy could generate media buzz and impact token value, highlighting the volatility and unpredictability in the crypto market.

StubHub CEO reveals IPO pricing while oil spreads narrow to -$4.30

StubHub's IPO is set against a backdrop of rising consumer demand for live events, making its pricing strategy crucial for success. The narrowing WTI/Brent spread indicates U.S. crude is becoming more attractive to international buyers, creating opportunities in export-related investments. Both the live events and oil markets are showing signs of recovery post-pandemic, presenting unique investment opportunities.

Tencent CEO just raised $1.27 billion at rock-bottom rates - here's why AI spending is slowing

Tencent raised $1.27 billion in the bond market with ultra-low interest rates due to high investor demand. The company is adopting a conservative approach to AI spending, reducing expenditures while competitors splurge. This cautious strategy may appeal to investors looking for stability in a volatile AI investment landscape.

Binance CEO negotiates exit from $4.3 billion DOJ babysitter deal

Binance is seeking to have its government-appointed compliance monitor removed after settling a $4.3 billion money laundering case, claiming they've improved their practices since the settlement. The DOJ's decision could set a precedent for future regulatory oversight in the crypto industry, potentially influencing how other firms handle compliance monitoring. While Binance wants operational freedom without external supervision, the removal of oversight raises concerns about trust and investor protection in the volatile crypto market.

UK and US governments reveal their crypto collaboration strategy - here's what it means

The UK aims to improve its crypto reputation by adopting more flexible regulations, aligning closer with American policies. European policymakers are realizing that private digital currencies are outpacing their own efforts, prompting a shift in attitude toward blockchain innovation. The UK's regulatory framework strives to balance caution with practicality, potentially smoothing the path for crypto transactions and integrating digital currencies into traditional finance.

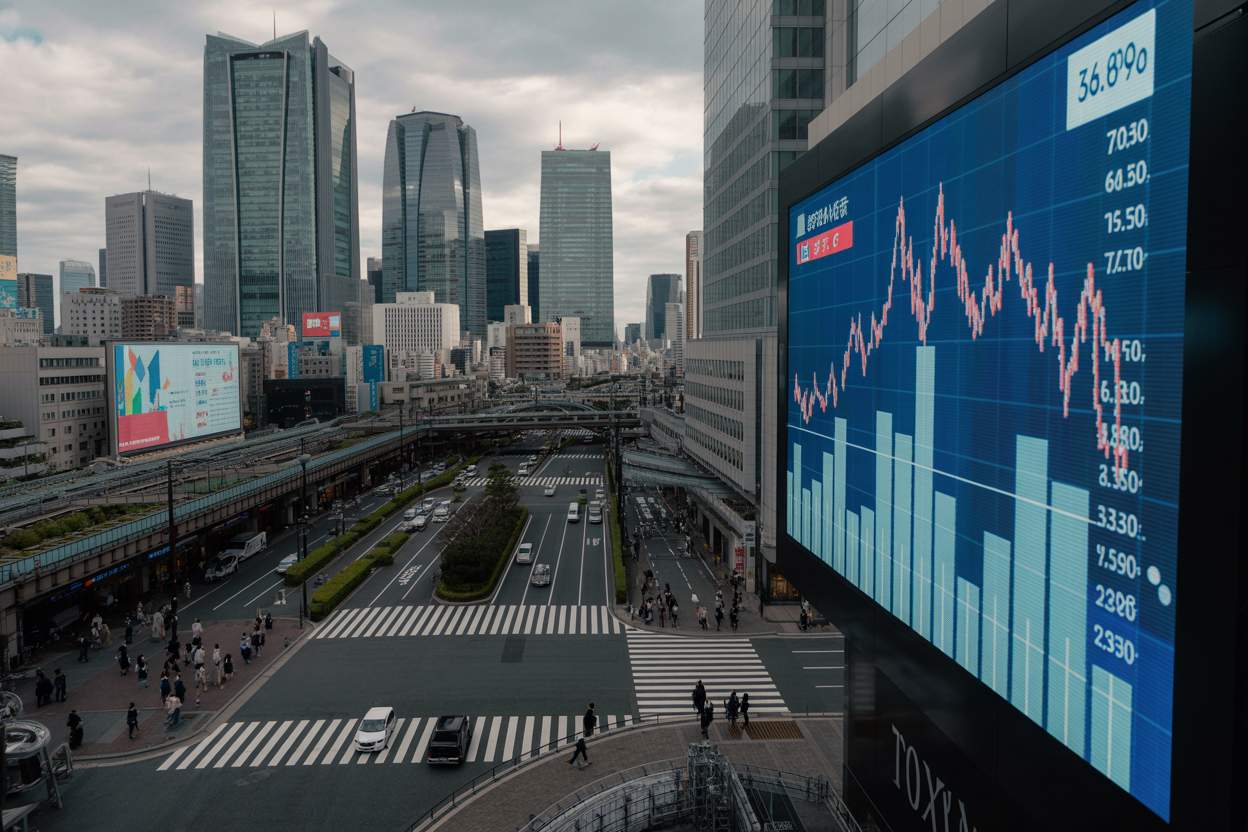

Japan's exports fall 4 months straight as 15% tariffs bite - here's why Asia's 20% rally might be fake

Japan's exports have declined for four consecutive months due to increased U.S. tariffs, signaling deeper economic issues beyond just vehicle tariffs. Despite a rising Asian stock market, analysts warn that this rally is based on optimism rather than solid economic fundamentals, particularly impacting U.S. export-dependent countries. Southeast Asian manufacturers are showing resilience, and potential Federal Reserve interest rate cuts could provide some economic relief, suggesting investors should diversify away from export-heavy firms.

$21 Billion Neocloud Race: Why ASEAN Telcos Are Ditching Towers for AI

91% of ASEAN businesses foresee generative AI disrupting their operations within 18 months, triggering a rush among tech giants like Microsoft and Oracle to enhance AI cloud offerings. Telecom companies in Southeast Asia, such as Singtel and Indosat, are transforming into AI cloud leaders with substantial growth prospects, while startups must innovate beyond just using AI to capture investor interest. Investors should adopt a dual strategy of supporting high-growth tech companies while also seeking undervalued firms that can successfully navigate the AI-driven market landscape.

Singapore REIT investors just bagged $1.5B in acquisitions - here's your DPU roadmap

Singapore REITs are making strategic acquisitions this September, finally showcasing strength after months of rate anxieties. CapitaLand Ascott Trust and AIMS APAC REIT are boosting their DPU with smart property purchases, while Keppel DC REIT impresses with a 12.8% DPU increase. Investors should focus on diversification into high-growth sectors and monitor economic indicators for sustainable growth opportunities.

This dividend king just plunged 40% while S&P 500 soars - here's why

Target's sales have plummeted 40% in the past year as consumers prioritize value over luxury, while competitors like Walmart thrive. Despite its struggles, Target announced a 1.8% dividend increase, showing confidence amid turmoil and changes in management. Investors may find attractive prices with a high dividend yield, but caution is advised as the company's recovery remains uncertain.

Japanese automakers face 15% tariff relief while Indonesia threatens 80% export advantage

Indonesia's EU trade deal will make 80% of its exports tariff-free, challenging Japanese automakers' market position. Japanese car manufacturers face ongoing high tariffs while Indonesia gains a pricing advantage in Europe. Companies must adapt through localized production and strategic partnerships to survive in the shifting automotive market.

Cotton traders who spotted this 75-point surge reveal why oil prices could ruin everything

Cotton futures rose 34 to 75 points amid poor crop conditions, with only 52% of U.S. crops in good condition, heightening supply concerns. Oil executives are pessimistic as OPEC+ plans to boost production, putting further pressure on cotton prices due to cheaper synthetic alternatives. Upcoming USDA export sales report may reveal if international demand can offset domestic supply issues, while cotton traders remain cautious about oil market influences.

Analysts rate JD.com a buy at $43 target - but it's stuck at $31

JD.com reported a strong 22% revenue growth, yet its stock languishes around $31 despite a reasonable $51 target price, reflecting market skepticism. Institutional investors are buying in, indicating potential confidence in JD.com's future, while retail sentiment remains wary. With upcoming Q3 earnings as a significant milestone, JD.com may either validate its operational prowess or deepen market doubts.

Oracle CEO just bet $300 billion on OpenAI - here's what it means for your portfolio

Oracle invests $300 billion in OpenAI over five years, risking their financial stability as OpenAI faces massive cash burn and competition. While Oracle's recent share jump reflects initial excitement, long-term success hinges on OpenAI's growth and overcoming significant financial challenges. This partnership could propel Oracle to AI infrastructure dominance, but comes with severe risks of over-reliance on a single customer and mounting debts.

Fed Chair who controls $8 trillion reveals why tomorrow's 0.25% cut matters

Jerome Powell is expected to announce a 0.25% rate cut amid concerning job growth and rising unemployment, with August adding just 22,000 new positions. Inflation remains persistent, forcing the Fed into a dilemma of cutting rates to stimulate employment while risking further inflationary pressure. Market reactions hinge on Powell's forward guidance; confidence could spark a tech rally, while cautious remarks may lead to increased volatility.

Binance's $4.3B settlement monitor might disappear - what it means for your crypto

The DOJ is reconsidering its compliance monitor for Binance, questioning its effectiveness amidst high costs. The shift in regulatory approach could impact how crypto exchanges navigate compliance as they face different standards from regulators. Crypto companies should prioritize strong internal controls, as reduced oversight doesn't eliminate the need for compliance amid evolving regulations.

DreamFolks CEO just shuttered domestic lounges - here's what it means for your travel portfolio

DreamFolks Ltd. has terminated its domestic lounge operations as airport operators prefer direct access over middlemen. The company's reliance on lounge access has left it scrambling for alternatives while trying to innovate for survival. Their comeback strategy involves focusing on global operations and creating bundled services to retain clients amidst market challenges.

UBS CEO reveals 51% payout boost - why top advisors are staying put

UBS is revamping their advisor compensation ahead of schedule, responding to a 3.8% loss in workforce due to competitor poaching. Payouts for advisors generating $1-3 million will increase, with special incentives for landing clients worth $10 million or more. Junior advisors are receiving more support, while UBS attempts to balance retention, integration of Credit Suisse, and regulatory pressures.

Nestle Chairman Steps Down After Stock Plummets 40% - What It Means for Investors

Nestlé's leadership overhaul begins as Chairman Paul Bulcke resigns and CEO Laurent Freixe is fired, amid a 40% stock drop and growing debt. New Chairman Pablo Isla aims to streamline Nestlé's extensive product lineup of over 2,000 items in an effort to boost profitability. Investors are demanding assurances of sound governance as they worry about the company's ability to maintain premium pricing amid consumer shifts.

New Hope Corporation's $36.5M profit drop reveals what coal investors should do next

New Hope Corporation's profit plummeted 7.7% despite an 18.1% increase in coal production due to falling prices, highlighting market timing issues. Logistical challenges further squeezed profitability, raising concerns about the coal industry's stability amid a shift toward renewable energy. Dividend cuts signal deeper financial troubles, urging investors to reconsider the sustainability of coal investments as the energy landscape evolves.

FTC targets Ticketmaster with $53,000-per-violation fines - here's what traders need to know

Ticketmaster claims to block 200 million bot attempts daily, but criticism arises due to ongoing scalping issues and control over 70% of the market. The FTC is investigating Live Nation's compliance with the BOTS Act, potentially leading to significant fines and regulatory risks for the company. Shareholders should monitor the situation closely, as ongoing investigations may impact Live Nation's stock performance and profitability.

Alipay+ CEO locks down 1.7 billion users with tennis partnership - here's the payoff

Alipay+ partners with the Laver Cup to tap into 1.7 billion potential customers, becoming the Official Payment Partner through 2029. This collaboration enhances fan experience by making payments seamless, while also expanding Alipay+'s reach in the Asia-Pacific region. Emphasizing security and convenience, Alipay+ aims to embed digital payments into premium sporting events, turning transactions into lifestyle integrations.

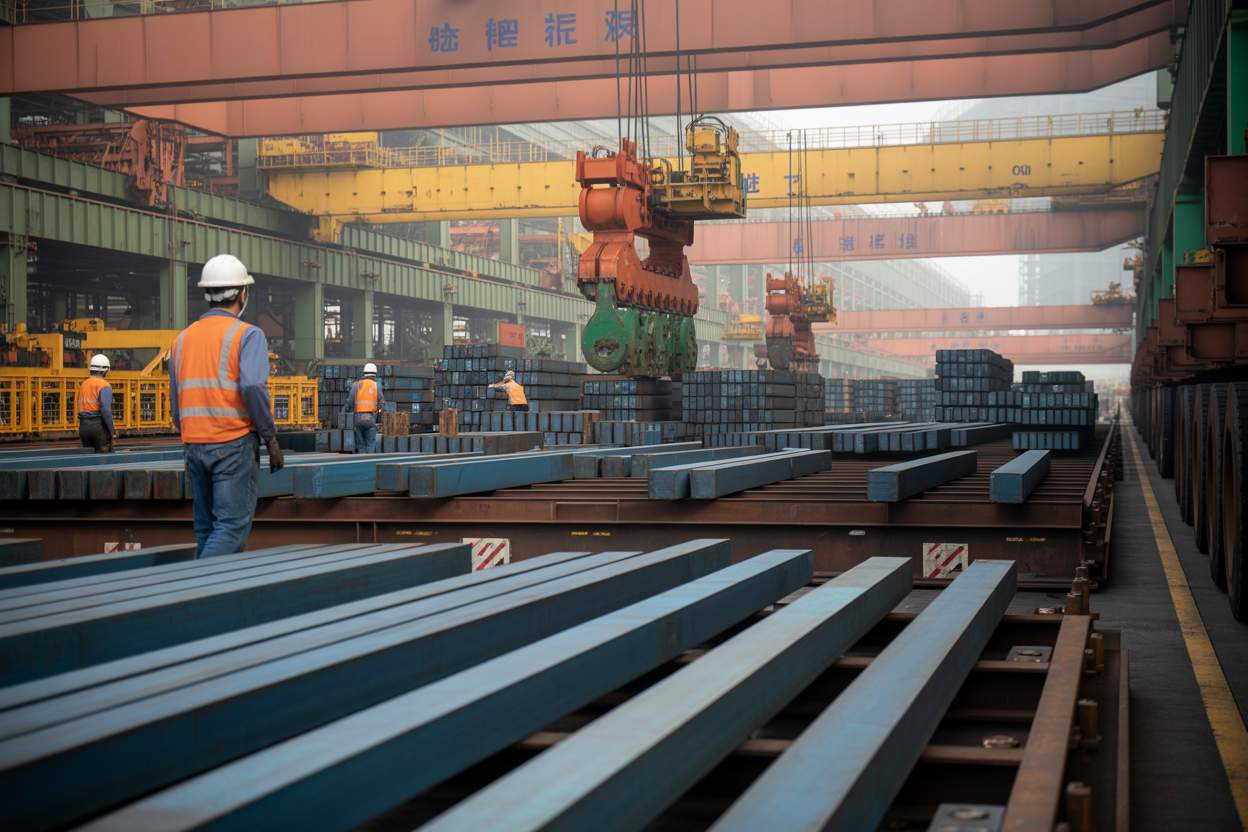

Chinese Steel Exports Hit Record High Despite 54 New Tariffs - Here's Why

China's steel exports are projected to hit a record 115-120 million metric tons this year despite facing 54 new tariffs, highlighting the industry's resilience in finding new markets. The collapse of the domestic property market has led Chinese steel producers to export aggressively, creating a cycle of retaliation with countries imposing more tariffs. While current export figures look impressive, analysts warn that the surge may peak this year, with potential drops in future demand due to ongoing trade barriers.

Suzlon CEO just landed ₹6,700 crore order - here's what it means for your portfolio

Suzlon Energy lands its largest contract of the year with Tata Power for an 838 MW project worth ₹6,700 crores, boosting investor interest in clean energy. With a solid order book and impressive revenue, Suzlon is positioned well in the growing renewable sector, but investors should be ready for volatility. Smart investing in clean energy requires patience as the market is unpredictable, despite promising partnerships and government initiatives.

This $420,000 crypto presale delivered 927% returns while BNB dropped 2.87%

Binance Coin and Litecoin dipped slightly, while presale project BullZilla ($BZIL) netted over $420,000, offering early investors returns up to 927%. BullZilla features FOMO mechanics that increase prices every $100,000 raised or 48 hours, incentivizing early investment and long-term holding. Investors face a choice between stable cryptocurrencies for steady gains or high-risk, potentially high-return presales like BullZilla, which claims explosive returns of up to 8,822%.

BlackRock CEO just raised S&P 500 target to 7,000 - here's why your portfolio could soar

BlackRock predicts the S&P 500 will rise to 7,000 by the end of 2025, driven by anticipated Fed rate cuts and AI contributions, despite ongoing inflation. A softening job market may surprisingly benefit stocks, turning bad employment data into a catalyst for easy monetary policy. While BlackRock is optimistic, other analysts like RBC Capital caution investors to prepare for potential market volatility as economic conditions may worsen.

Tesla CEO just bought $1 billion of his own stock while revenue drops 16%

Tesla stock is experiencing its best day in eight months, despite posting a decline in revenue and net income. Elon Musk's recent $1 billion investment in Tesla is seen as a vote of confidence amid challenges. Investors are betting on Tesla's ambitious robotaxi vision, but its current high valuation raises questions about future profitability.

BlackRock CEO launches WEQW ETF that turns tech dominance upside down

BlackRock's new WEQW ETF offers an equal-weighted approach, drastically reducing the influence of tech giants like Nvidia from 5.4% to just 0.26%. While WEQW could mitigate tech concentration risk, historical performance shows it lags behind standard indexes, with only 9.31% annualized returns compared to 11.65%. Investors seeking diversification might find WEQW appealing, but should be cautious of its potential underperformance in a late-cycle economic environment.

Japan's 20-Year Bond Yields Hit 2.67% - Bond Strategist Reveals Why This Changes Everything

Japan's 20-year bond yields rose to 2.67% and 30-year yields hit 3.25%, indicating higher returns demanded by investors amidst rising political uncertainty. Analysts predict a yield advantage of Japanese Government Bonds over foreign options by 2026, potentially boosting the yen and encouraging capital repatriation. Investors should monitor U.S. economic data and Japan's political situation as both can impact bond markets significantly.

AVNT token soars 280% to $1.54 but $4 million Sybil attack threatens your gains

AVNT token skyrocketed to $1.54 with a 280% surge, but a clever entity exploited the airdrop, siphoning $4 million through a Sybil attack. This event raises serious trust issues in the crypto space, akin to rigging an office raffle. Investors should watch Avantis' response to this crisis, as their actions will indicate if AVNT can regain trust or if it's headed for a downfall.

Gemini's $425M IPO surged 14% - Winklevoss twins reveal why crypto stocks matter

Gemini Space Station's IPO surged 14% on its first day, raising $425 million and joining major players like Coinbase in the crypto market. Despite posting significant losses, investor interest in Gemini highlights the growing appetite for exposure to digital asset companies. Traditional investors are shifting towards buying shares in crypto firms instead of directly owning cryptocurrencies, marking a new era for the sector.

Oil Giants Just Spent Millions 200 Miles Offshore - Here's Why Traders Are Paying Attention

BP's commitment to deepwater projects signals confidence in the energy market, with GATE Energy set to profit from their Kaskida Floating Production Unit. MITER Brands' sale of NewSouth Window Solutions highlights a strategic pivot towards energy-efficient manufacturing, tapping into consumer demand for sustainability. Companies adept at adapting to the evolving energy landscape, like GATE Energy and MITER, are positioning themselves for significant profit amidst the green rush.

Two CEOs just spent $540M on opposite strategies - here's what it means

Beazley PLC spent £30.8 million on a share buyback, indicating confidence in their undervalued stock despite high performance. United Tractors invested $540 million in a gold mining operation to diversify amid volatility in their traditional business. These moves highlight contrasting strategies: Beazley plays it safe by repurchasing shares, while United Tractors boldly pivots to seize opportunities in commodities.

Financial experts warn: Boomers hoarded $83 trillion while Gen Z eats ramen

Wealth accumulation and the impending $83 trillion transfer to Baby Boomers raise tensions as younger generations express frustration over economic disparities on platforms like TikTok. Young investors are shifting towards purpose-driven investing, prioritizing social impact over mere wealth hoarding, and advocating for improved financial literacy. Generational cooperation in finance is crucial; aligning financial goals with social responsibility is needed to ensure capitalism benefits all, especially the economically disadvantaged.

Biotech CEO Just Got FDA Approval That Sent Stock Up 6% - Here's Why

Krystal Biotech's Vyjuvek therapy for treating a rare skin condition in newborns received FDA approval, causing stock prices to surge by 6.01%. The at-home dosing feature of Vyjuvek offers significant convenience, making it a competitive advantage in biotech. Analysts believe the market is underestimating Vyjuvek's revenue potential, highlighting the importance of thorough investment analysis in the biotech sector.

Adani just won a $49M ropeway contract - here's why infrastructure investors are celebrating

Adani Enterprises has secured a ₹4,081 crore contract for a 36-minute ropeway to Kedarnath, transforming the pilgrimage experience. The company is riding a wave of investor confidence, with a recent 3% stock jump linked to this infrastructure boost. The government's ₹11 lakh crore investment in high-speed road networks signals significant opportunities for companies like Larsen & Toubro and IRB Infrastructure.

Chinese homeowners watch $1.4 trillion vanish as property prices drop 11%

Chinese home prices dropped 11% in August 2025, signaling a severe housing market crash exacerbated by slowing exports and consumer confidence. With mortgage lending contracting and rising unemployment, Beijing's monetary easing measures may prove ineffective without significant reforms to restore confidence. Investors should pivot to businesses diversifying markets away from the US and focus on growth sectors like tech and renewable energy amidst the economic turmoil.

Ethereum Foundation launches AI team - here's what it means for your crypto portfolio

Ethereum is launching an AI-focused research team, positioning itself as a key player in the integration of AI and blockchain technology. The Ethereum Foundation's new Privacy Stewards Initiative aims to enhance transaction privacy amid increased governmental scrutiny. With record funding for AI projects, Ethereum seeks to establish itself as a reliable infrastructure in the evolving AI economy.

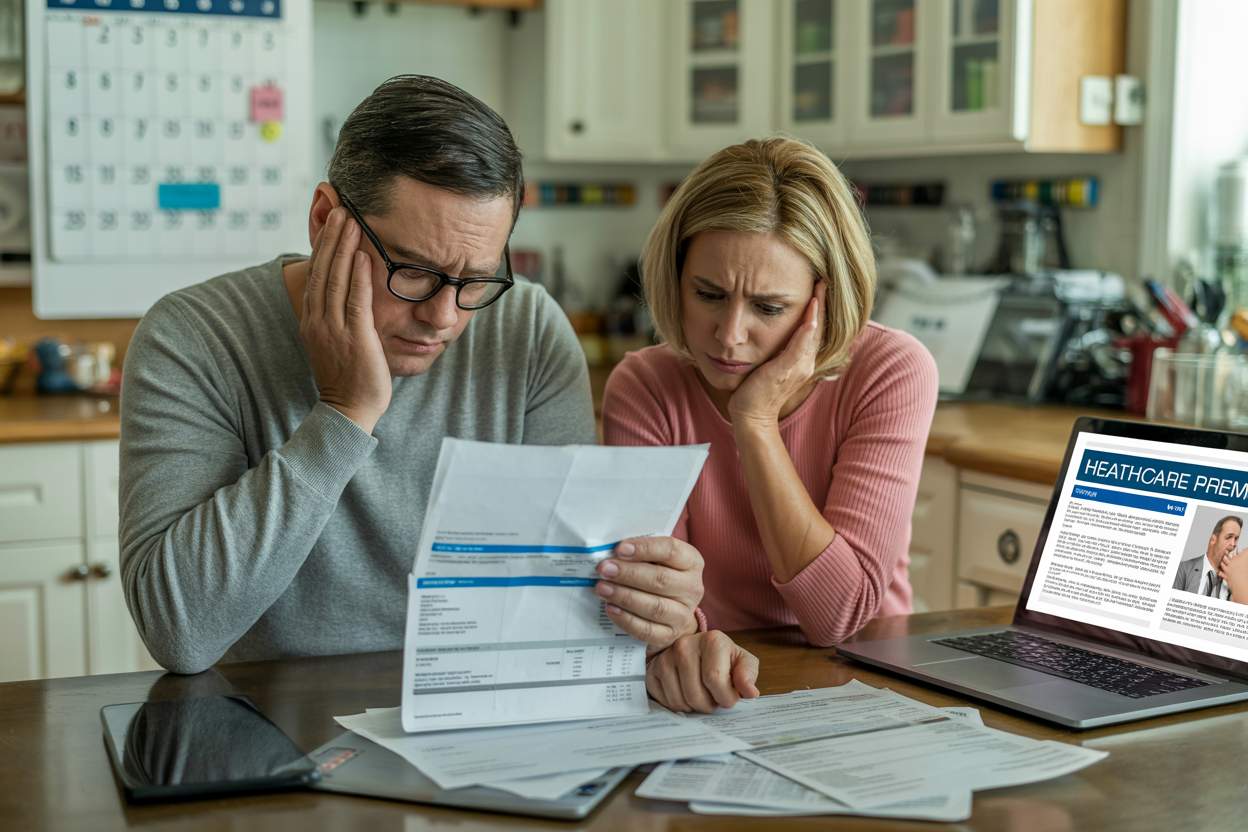

Bernie Sanders warns 20 million Americans face 75% premium spike - here's why traders care

20 million Americans could face a 75% hike in health insurance premiums if Obamacare subsidies are cut, impacting household budgets and inflation. Rising healthcare costs may hinder consumer spending, complicating the Federal Reserve's interest rate decisions amidst sluggish job growth. The potential for government shutdowns over subsidy negotiations adds to market uncertainty, urging traders to prepare for volatility in both healthcare and consumer sectors.

ANZ CEO faces $240M fine after bond trading disaster - what it means

ANZ Bank faces a record $240 million fine for overstating trading volume in a government bond deal and mishandling customer accounts. The bank's CEO, Nuno Matos, acknowledges poor performance as it plans to invest $150 million in reforms following a decade-long history of mismanagement. With 3,500 job cuts announced amid the scandal, ANZ's future hinges on transforming its problematic culture and addressing regulatory compliance issues.

Fed trader who predicted dollar's 10% drop reveals what's coming next

The dollar has dropped nearly 10% this year, with traders anticipating potential rate cuts from the Fed, impacting investment portfolios. As the dollar struggles, gold has surged nearly 40%, appealing to investors looking for alternatives amidst U.S. economic uncertainties. Weak job market signals and disappointing payroll reports are prompting market expectations for further rate cuts, creating opportunities beyond U.S. assets.

Executive who grew Broadridge from $3B to $30B just stepped down - here's why

Vijay Mayadas left Broadridge Financial Solutions after transforming it from a $3 billion to a $30 billion company over 12 years, showcasing exceptional growth. Broadridge is set to capitalize on the T+1 settlement timeline and evolving market demands with innovative tools like OpsGPT. With market optimism rebounding and strong corporate spending, investors should monitor leadership changes and tech integration as key profit indicators.

Vikram Solar just scored 200 MW order - stock jumps 4% to Rs. 370.80

Vikram Solar secured a 200 MW order from AB Energia, raising its stock by 4% to Rs. 370.80 as investors react positively to its growth prospects. With plans to ramp up production capacity from 4.5 GW to 17.5 GW by FY27, Vikram Solar is positioning itself as a key player in India's solar market despite facing margin pressures and revenue dips. Investors should remain cautiously optimistic as Vikram Solar navigates the competitive landscape and regulatory changes in the renewable energy sector.

Klarna's $17B IPO just triggered the biggest fintech race since 2021

Klarna's $17 billion IPO success signals a revival in fintech, urging others like Stripe and Revolut to consider public offerings. With clear market interest and consumer finance regulations improving, a wave of fintech IPOs may be on the horizon, following Klarna's lead. Starling Bank and others are quietly preparing for U.S. expansion, showcasing that smaller players can also make a significant impact in this refreshed market.

Nigeria's $639M Export Drop: CEO Reveals Why This Trade War Could Actually Pay Off

Nigeria's exports to the U.S. plummeted by 41% amidst rising tariffs, sparking a trade crisis for both nations. Experts suggest Nigeria seize this chance to diversify its trade partnerships, moving away from its reliance on America. The ongoing tariff strategy may lead to supply chain issues in the U.S., benefiting other countries eager to engage with Nigeria.

This week-old crypto just hit $0.99 after landing on Binance - here's the catch

AVNT skyrocketed to $0.99 in just a week, fueled by major exchange listings and a strategic airdrop of 12.5% of its tokens. While market sentiment is currently optimistic, potential buyers should be cautious of volatility and consider diversifying their investments. The future success of AVNT will depend on its platform's performance beyond just hype and strong exchange connections.

Tesla announces stock buyback while Musk eyes $1 trillion pay - here's why

Tesla announces a stock buyback amidst rising unemployment and inflation, aiming to calm shareholder nerves while facing business challenges. Elon Musk's dual focus on a massive compensation package and investments in xAI raises concerns about Tesla's financial priorities and transparency. The upcoming shareholder meeting will be pivotal for Tesla, as investors seek clarity on the company's strategy amid economic uncertainty.

Bitcoin hits $114,817 as 95% of traders bet Fed cuts rates Tuesday

Bitcoin is currently at $114,817, showing a slight dip from yesterday but an 8% increase over the last two weeks, as traders anticipate a 25-basis-point interest rate cut from the Fed. The Producer Price Index is at 2.6%, lower than expected, fueling speculation that the Fed might be more inclined to cut rates, which typically boosts Bitcoin's popularity. With institutional interest growing and a critical resistance level at $116,000, Bitcoin's price trajectory hinges on upcoming Fed decisions and market sentiment.